Those are your electric bills going up in … steam. (You thought I was going to say “smoke,” didn’t you? See, I know things.)

Those are your electric bills going up in … steam. (You thought I was going to say “smoke,” didn’t you? See, I know things.)

By Frank Andorka, Senior Correspondent

No matter how many utility executives say, “We don’t have enough information to decide whether the President Trump nuke bailout is a good idea yet,” the people who know stuff – you know, experts – have weighed in, and the news is not good.

At the same time Exelon’s CEO was telling a crowd at the Edison Electric Institute’s annual meeting that no one had any idea whether Trump’s plan to mandate that grid operators buy electricity from failing nuclear and coal plants was a good one yet, the Nuclear Information & Resource Service (NIRS) was saying that the planned federal handouts for nuclear alone could add up to $280 billion to electricity bills by 2030. That’s $17 billion per year in unnecessary money being shelled out by ratepayers like you and me.

It probably doesn’t need to be said, but Exelon owns all or a portion of 16 nuclear plants throughout the United States. So maybe he’s a bit … what’s the word … biased in favor of a Trump nuke bailout.

The NIRS also said in a release that:

Forcing the purchase of overpriced and non-competitive nuclear and coal power also would crowd out renewables, leaving the U.S. farther behind in wind, solar and energy storage technology development and use.

Because if there’s anything the United States needs right now, it’s to fall even further behind in new electricity-generation technology. Gotta keep those coal jobs alive somehow, I guess.

Tim Judson, executive director, Nuclear Information & Resource Service (NIRS), said (emphasis ours):

By pushing for a nationwide bailout for nuclear power and coal, the Trump administration is rushing headlong into an energy buzz saw, and they don’t even seem to know it. Subsidizing the nuclear industry alone is likely to cost American consumers $8 billion to $17 billion per year, and subsidies for coal could cost just as much. Betting on old, increasingly uneconomical nuclear and coal power plants as a national security strategy is like gold-plating a Studebaker and calling it a tank. And it could destroy the booming renewable energy industry, which is already employing more Americans than coal and nuclear combined.

The words for this madness, they fail.

More:

Exelon CEO: ‘We Need Federal Intervention’ on Grid Resilience

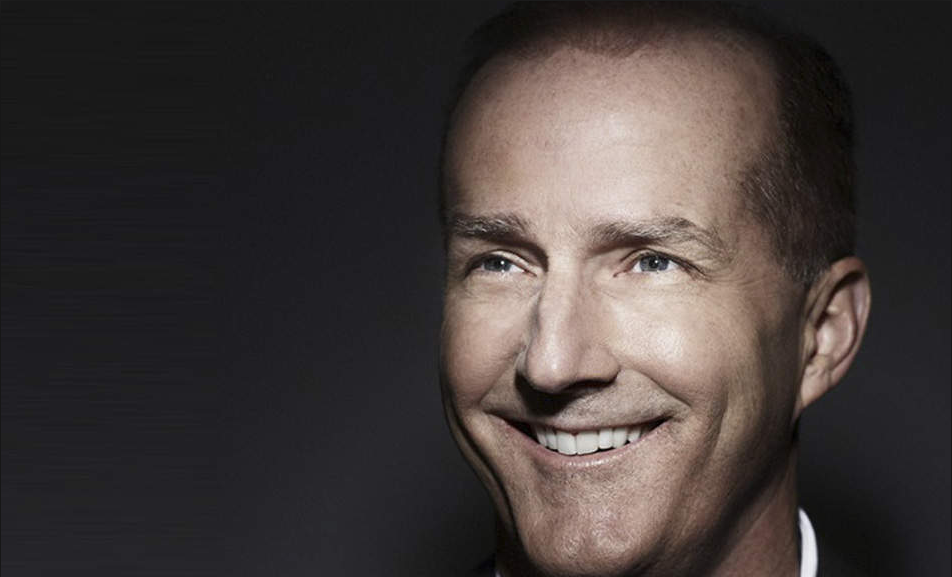

Former NRG Energy CEO David Crane

Former NRG Energy CEO David Crane