By Frank Andorka, Senior Correspondent

As you might imagine, the word on everyone’s lips at Intersolar North America – in addition to solar – is storage. Specifically, the question is how much storage can the United States expect to have installed and how quickly it can come. Fortunately, Kelly Speakes-Backman, CEO of the Energy Storage Association, was attending the show to answer exactly those kinds of questions.

Speakes-Backman informed the audience at the insanely broadly titled “The Future of PV” session that the United States installed 1 GW of storage last year and is on pace to double that this year to 2 GW, though she was quick to emphasize time and again that she is not just talking batteries – the storage method on which most people in the room and in the general solar industry are focused.

“Battery storage is growing exponentially,” Speakes-Backman told the crowd. “But that is not the only technology out there. We represent everything from pumped storage to flywheel to lithium-ion batteries, so it’s important to note that because everyone assumes you’re only talking batteries when you start talking storage in this kind of setting.”

She noted she has been talking to Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association, frequently about what binds the two industries together and what policy initiatives on which the two associations can collaborate. The two have decided they can collaborate on tax treatment and permitting, streamlining both tax credit eligibility and cutting back on the regulatory headaches associated with the latter.

“It’s great that people can get the investment tax credit if they pair solar + storage, but we believe that storage should be able to get the tax credit by itself,” Speakes-Backman said. “That’s important, and that’s something on which we’re working.”

By 2023, Speakes-Backman said the majority of new energy storage installs will be behind the meter, and by 2025 that number will blossom to 50%.

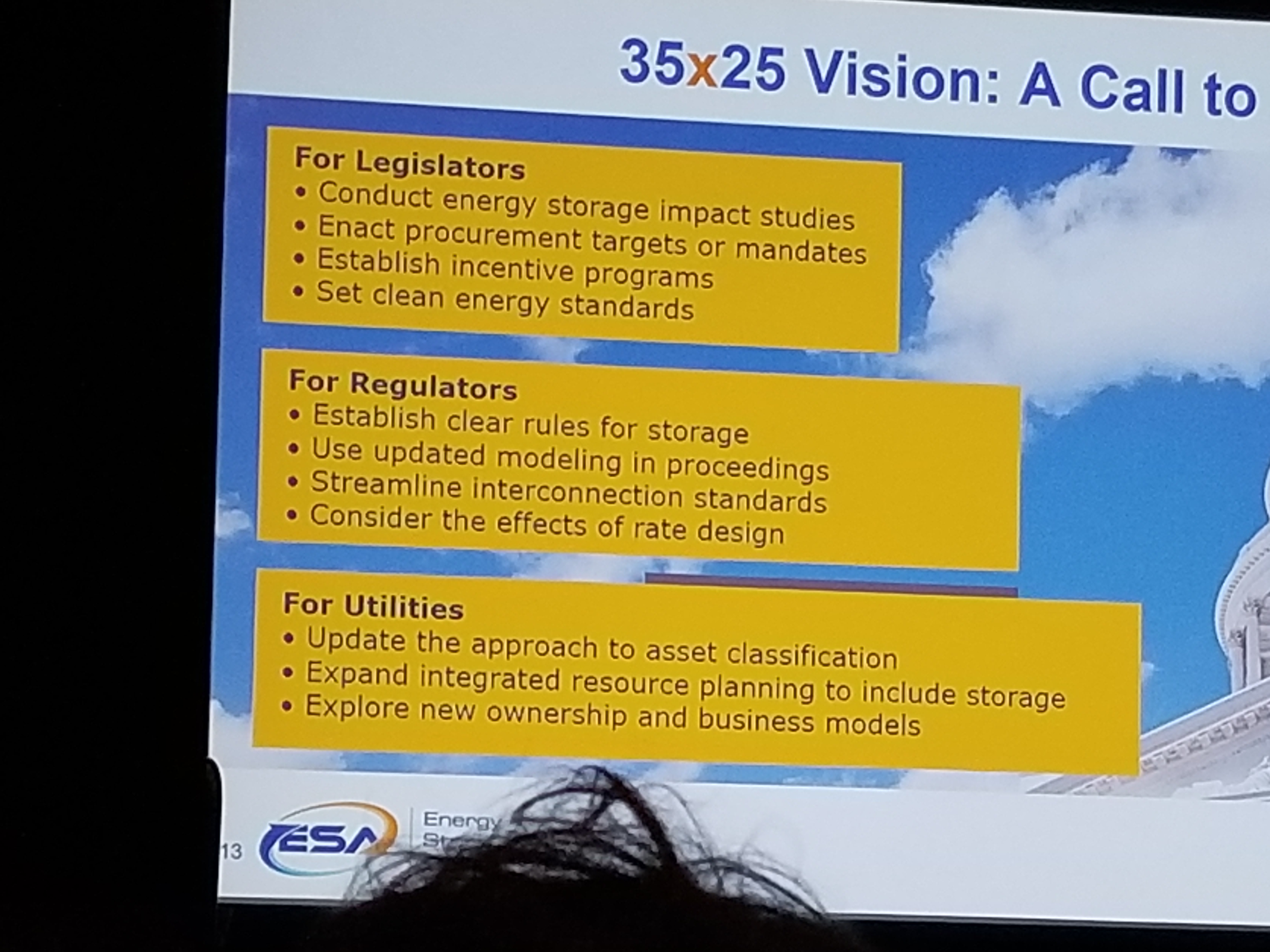

But storage has so much more to offer than than the spread of renewable energy. She said the energy storage industry could create more than 167,000 new jobs if the regulatory structures are put in place to make it happen. The goal, she says, is 35 GW of energy storage capacity by 2025 – and she believes that goal is eminently reachable. You can see how she proposes to do that below.

This is a great roadmap on how to get the 35 GW of storage by 2025, courtesy of Kelly Speakes-Backman, the CEO of the Energy Storage Association.