By Yann Brandt

Greentech Media’s Solar Summit 2015 (#GTMSS2015) brought together over 500 of solar’s brightest. The solar summit tends to be a bit different than many other conferences since the focus is on data and research, rather than products and services. The event kicked off with Shayle Kann of Greentech Media, who broke down the current state of the solar market and with some sharp analyses. For the full coverage on the presentation, see here.

Greentech Media’s Solar Summit 2015 (#GTMSS2015) brought together over 500 of solar’s brightest. The solar summit tends to be a bit different than many other conferences since the focus is on data and research, rather than products and services. The event kicked off with Shayle Kann of Greentech Media, who broke down the current state of the solar market and with some sharp analyses. For the full coverage on the presentation, see here.

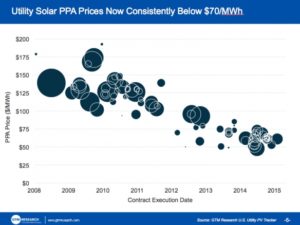

- Utility Scale Solar Costs Decline and Offtakers Base Grows

Utility scale solar is now consistently below $70/MWh and is being installed around the world at rates that match this new price, which shows signs of exponential growth. Now, to create new markets, we need a stable offtake environment and the lowest prices possible. There is cost to risk, so a 30-year merchant solar plant would likely average rates higher than $70/MWh. On the other hand, there is value for a hedge, which solar energy provides to utilities.

How does this affect the solar market?

With these lowered prices plus community solar, virtual net-metering, and direct access to customers who want solar, solar developers can sell the energy directly to users. Just look at the 130MW project for Apple — all of that energy is purchased by Apple but produced by a single, massive solar farm.

- Residential Solar Market Gets Saturated

While there are 113 million households in America, it seems only 9 million can actually receive solar cost effectively. First, you start by removing the homes that are rented. Then, you narrow to homes in states that support solar and homes with sunny enough roofs. After, you need people with the proper FICO score. The total number of viable homes goes down 90%, leaving just 9 million homes. One interesting reduction is the 38 million homes in solar friendly states to 29 million homes that have the right FICO score.

How does this relate to other solar markets?

Imagine doing the same analysis in commercial solar. Going from all commercial buildings to commercial buildings in solar friendly markets is an easy analysis and in some markets represents almost 50% of total energy usage. For hypothetical purposes, let’s assume that the same is true for commercial and 33% of buildings are in solar friendly states.

Looking at the prior cutoff, does the tenant own their building? Probably a lower number than the residential comparison, but looking at the next question of “how many tenants/building owners have a FICO of over 680?”

That is the question of the day in my mind. How do you index the commercial solar credit outside of publicly traded customers? Yes, you can look at three years of financial statements, but how can you do that quickly and cost effectively?

- The bundles energy market is here, going to get bigger, and more utilities are getting involved

We have already seen utilities get into non-regulated solar development and owning solar assets in their portfolio. Innovation, on the regulated side of utility headquarters, is becoming more prevalent. Florida’s investor-owned utilities have brought this up to the tune of nearly 1GW, and other states have already seen their regulators make decisions on this new era of energy system. On the other hand, things are also getting smaller like partnerships with EV charging stations, demand response systems, or home automation.

Does solar really benefit from this?

More solar is always a good thing for the sector, it means more jobs, more manufacturing, and more competition that drives the cost of capital down. Equally important, we can put resources toward the customer experience when we know there are plenty.

In the past it was a challenge to bring the rooftop industry down to eye level by doing a monitoring setup or something similar. Today, the ability of a bundled package increases the touchpoint between solar generation and the customer, which will make many more users become solar evangelists.

Being at Greentech Media’s Solar Summit was another great learning experience. Speaking on the crowdsourcing panel, I was, as usual, surprised by the general consensus of the industry. So while it always seems like I am a contrarian, I saw it more like an opportunity to have my thoughts challenged. The next events for me are Intersolar, Solar Securitization, and REFF Wall Street. I look forward to meeting you there.