Solar Forecast: Sunny After Some Scattered Clouds

By Yann Brandt

Solar is often presented in a complicated way to those not living in the industry on daily basis. We all know the headlines: bankruptcies, tariffs, utility smears and more. It is easy to understand that while solar enjoys a positive approval rating, there are legitimate questions. So when smart and successful people ask good questions and want to get on the supporting side of solar, I listen.

Solar is often presented in a complicated way to those not living in the industry on daily basis. We all know the headlines: bankruptcies, tariffs, utility smears and more. It is easy to understand that while solar enjoys a positive approval rating, there are legitimate questions. So when smart and successful people ask good questions and want to get on the supporting side of solar, I listen.

So the questions to be answered: Is solar’s current success permanent? And can it become profitable for investors in projects and companies? In a lighting round of updates, here is your current weather report for the solar industry.

Result of the tariff battles

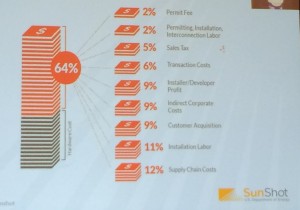

Without a doubt, the tariffs imposed on solar equipment are bad for the industry. The latest round adds a cost of approximately $0.10-$0.15 cents per watt and brings the cost of modules into the mid $0.80s for larger purchases. These are costs that are going to impact the profitability of the value chain including the installer and financing party. In the end it increases the cost of solar electricity or slows the decrease of costs the industry has benefited from.

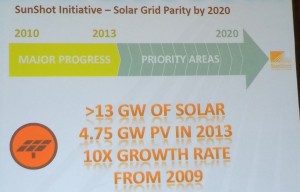

Companies will aim to work around the tariffs and will most likely open manufacturing lines in free-trade Countries like Mexico in the near future. SolarCity has already announced plans for their plant in New York and expect more of this to occur. In the meantime, don’t expect the tariff to slow the speed of development in the solar industry.

Markets and sectors

Solar can be separated into four categories: residential, commercial (private), commercial (public) and utility scale. In general, residential is growing (rapidly) and utility scale is now slowing year over year. Both of these segments have become very exclusive for investors, Wall Street with residential and utilities buying large solar farms. Commercial solar is primarily separated into investment grades. Good credits, like schools, government buildings and publicly traded companies, have access to scalable third party financing products. PPAs rule the commercial space which requires scale. All other commercial is essentially untouched and probably the biggest market opportunity alongside residential growth.

Markets are separated in geographies across the Country with each State representing multiple markets. Due to regulations and existing infrastructure costs, electricity customers see a different benefit from installing solar. Residential solar markets are now active in almost 20 States, getting us closer to a national effort to put solar on every home.

Effect of rising interest rates

Probably one of the biggest upsides to the solar industry is the cost of capital. Even in a low interest rate environment, solar projects still pay very high rates. Investors currently view solar as an investment with some risk with most investors seeking high single digit or low double digit returns. Solar debt in PACE markets still achieve project based returns above 6%, which is incredible considering that recent securitizations in PACE and residential solar have been in the 4.5% range.

Things are looking up however, with future securitizations continuing to drop the cost of capital in solar. Scale and more investor success will drive competition into these investments, therefore lowering the cost of capital further, one day matching the rates we see in residential and commercial mortgages.

What is hot in solar?

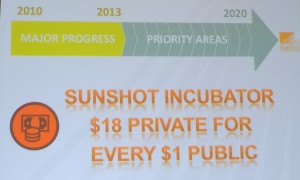

Software and financial innovation is driving more investment downstream in the sector. Financial models such as crowd funding and credit enhancements create an opportunity for more people to invest in and benefit from solar energy.

Software (cleanweb) is creating the ability for solar development platforms to lower the cost of each project. Developers are coming into solar to solve pricing inefficiencies, permitting issues and make complicated things like solar layouts an easy task. We continue to see financial and cleanweb startups making a very good case for more venture capital investment in solar.

What does solar need?

We cannot increase the amount of sunlight but we can add more participants in the industry. All of those angel investors that are funding the next software app or website should look for a solar version. Made money on a financial advisory firm? Invest in the next solar financing model. In short, solar needs the innovation that is happening to get more capital runway.

The importance of helping the development and efficiency of project development is that it helps the speed of project capital deployment. Billions of dollars are looking for a solar project to call home, the problem being that there are not sufficient investment opportunities in the marketplace.

Clouds in solar are causing the current turbulence we are encountering. The forecast however is sunny skies and smooth sailing in the near future. Hope you enjoy your trip in solar!