3 Ways Permitting Creates Opportunity

By Yann Brandt, Managing Editor of SolarWakeup

California made some headlines with Assembly Bill 2188. The bill made it through the State Assembly generally easily with a 58-8 vote after two unanimous votes in committee. The bill would help residential solar installations get their permit more efficiently or at least in a more pre-determined process. Permits would have to be issued within 5 days and probably more importantly the system would only be inspected after installation.

California made some headlines with Assembly Bill 2188. The bill made it through the State Assembly generally easily with a 58-8 vote after two unanimous votes in committee. The bill would help residential solar installations get their permit more efficiently or at least in a more pre-determined process. Permits would have to be issued within 5 days and probably more importantly the system would only be inspected after installation.

Having recently installed solar on my home, I can speak from experience that putting a 5kW on a home is not simple. Between the back and forth from the engineers and various Town departments, it took over 3 months from initial submittal to receipt of the permit. The mess of residential solar permitting processes creates enormous opportunity for various solar players; if only on the basis that several hundred thousand systems have already installed. Before long, we will have more than a million homes with solar, and reducing the time and cost associated with permitting will enable some to take financial advantage of this hurdle.

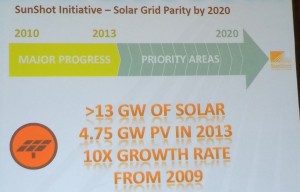

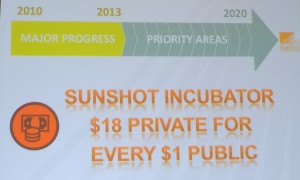

In California, installers currently work in around 500 municipalities with nearly none of them following the same process. The effort of AB 2188 along with SunShot efforts such as Go Solar in Broward County, Florida can create the uniform requirements that solar is looking for.

Assuming things clear up, let’s review three ways that solar companies could take advantage of the new rules.

App based solar permitting embedded in Sales

Some startups have already begun working on the concept. Sign up a customer and before leaving stand in front of the home and take some pictures on your iPad. The app, with the help of Google Earth aerial imagery, estimates a system size that the sales person can verify on site based on energy usage. Through the software’s locational awareness, the permitting guidelines are taken into account and a system design is created based on your product choices.

It seems a bit farfetched but realizable in short order with the simple creation of permitting guidelines that create scale in developing the software. Nobody is going to develop the app for 500 markets in California, but for an entire State it could be in our foreseeable future. Imagine the possibility of closing a sale and building a permit package before leaving the site on the first visit; scalable efficiency generated by smart regulations.

Welcome the era of micro-inverters?

A few years ago, residential providers actually allowed homeowners to select an installation date for their project on the website. Of course, prior to the actual installation, an installer had to visit the site and measure the roof. Google Earth, Pictometry and other are pretty accurate but nothing will replace the hand measurement of a home. Pipes, shading and other potential hazards are always missing from the imagery.

With micro-inverters, the permitting is in many ways agnostic to a few panels more or less. An installation crew simply comes to the site and understands the technical parameters that need to occur for the financial model to work. Trucks will come prepared with extra materials and a few more panels than the job calls for, no need to come back a second time or change out the inverter in the permitted designs.

This isn’t farfetched; during my installation I was not sure if the southern faces would end up working for all 20 panels due to the location of the exhaust pipes from the bathroom and kitchen. By using micro-inverters, I was able to plan for either scenario from the start and notified the building department ahead of the time that some panels had a potential secondary location.

More solar everywhere

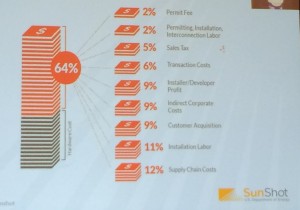

Take away the significant cost of permitting, and you probably shave $0.30-$0.40/watt off the installation. By making it more efficient thus reducing the site visits and engineering costs, it may be possible to remove a large portion of the soft cost.

Removing costs, lowers the cost of solar for the consumer and in turn opens more markets. At $0.115/kWh in Florida, residential solar is very close to making financial sense for solar loans and solar leases. With improved permitting processes and installation efficiencies, these markets become immediately viable. By the time that President Obama gives his last State of the Union, we could hear solar is being installed every minute.

In a utopian vision, residential solar installations will have no technical site visits for installation or permitting. The only company representative that ever comes to the site is the sales person with some software. It all starts with Government taking away the significant barriers that have no effect on safety; it just creates uniform standards based on the local building codes.