By Frank Andorka, Senior Correspondent

The investment tax credit (ITC) has been one of the most successful methods for supporting solar development at the federal level for nearly the past decade. Under its provisions, solar consumers can take a 30% tax credit on their tax returns if they install solar electricity (though under a 2015 extension, the amount of the credit starts to go down starting in 2020.

As energy storage has become more of a factor in people’s decisions to go solar, however, there’s been a growing movement that would add energy storage projects into the ITC as a method of encouraging the growth of this ever more important market.

To that end, the Solar Energy Industries Association (SEIA), alongside a broad coalition of energy trade and advocacy organizations, sent a letter to Congress asking it to to modify the tax code to include energy storage as an eligible technology for the ITC.

SolarWakeup reached out to Abigail Ross Hopper, president and CEO of SEIA to find out more.

SolarWakeup (SWup): Why now?

Abigail Ross Hopper (ARH): Why not now? It is important for our grid, has strong bipartisan Congressional support and represents a big opportunity for clean energy, particularly solar. We know there is going to be tax legislation moving in the lame-duck session, and we think this is the perfect time to get this fix done.

SWUp: Is there a bill to do this already in the works?

ARH: The bill we’re urging Congress enact is the Energy Storage Tax Incentive and Deployment Act of 2017 (S. 1868/HR 4649).

SWup: What fix are you looking for specifically?

ARH: We are urging Congress to fix the investment tax credit in Sections 48 and 25D of the tax code to include energy storage as an eligible technology.

SWup: What do you think the chances of passage are?

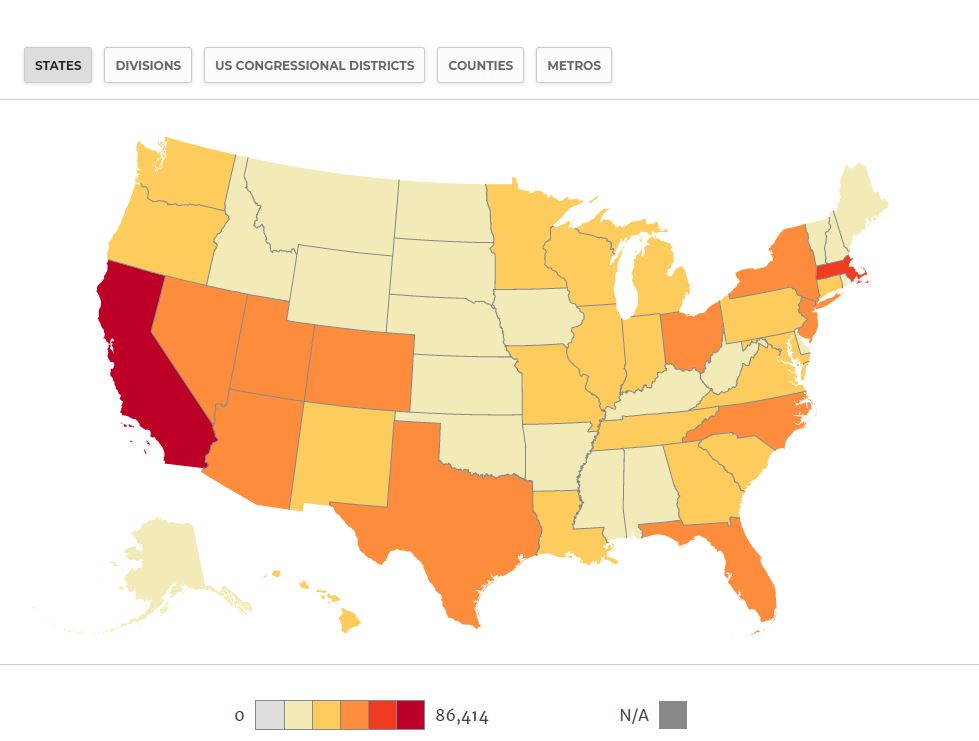

ARH: We know from our visits with members from the top 100 solar districts that there is broad bipartisan support for applying the ITC to storage, and we believe it has a very good chance of still being included in legislation this year.

SWup: What impact do you think this would have on the solar industry going forward?

ARH: Many of our companies are storage companies too. This is a common-sense bill that will encourage investment, jobs and accelerated deployment of solar plus storage projects across the country. It’s a no-brainer.

SWup: Are you seeing situations where not having ITC eligibility is inhibiting deals from getting done?

ARH: Yes. For example, for utility-connected storage (Sec. 48) or community solar (Sec. 25D), where the storage technology is in front of the meter, the current requirement that 75% of the electricity comes from storage serves as a disincentive for investment in solar + storage. Eliminating this would make tax equity easier to obtain.

This would also allow retrofits to qualify, and currently they only do under very specific conditions.